Tata Tech, a key entity within the renowned Tata Group, plays a pivotal role in the technology and engineering services industry. Its share price serves as a vital gauge of market performance and reflects investor confidence in the company’s prospects.

Historical Context of Tata Tech Share Price

Tata Tech’s share price history showcases its journey from a niche player to a global leader in technology and engineering services. Investors have observed various price fluctuations driven by strategic initiatives, market growth, and economic changes. Analyzing this historical data helps in forecasting future trends and making well-informed investment decisions.

ALSO READ> TCS on Foreign Travel: A Comprehensive Guide

Key Factors Affecting Tata Tech Share Price

Several factors influence fluctuations in Tata Tech’s share price:

- Company Performance: Key financial metrics like revenue growth, profit margins, and earnings per share (EPS) significantly affect the stock.

- Sector Trends: Developments in the technology and engineering sectors shape Tata Tech’s market performance.

- Economic Indicators: Broader economic factors, such as GDP growth, inflation, and interest rates, impact investor sentiment and share value.

- Regulatory Changes: Shifts in regulations and compliance standards can affect Tata Tech’s operational efficiency and stock price.

Recent Share Price Trends for Tata Tech

Analyzing recent share price trends provides valuable insights into Tata Tech’s market dynamics. Recent movements have been influenced by factors such as new project launches, technological innovations, and strategic partnerships, offering a clear view of the company’s future growth potential.

Financial Health of Tata Tech

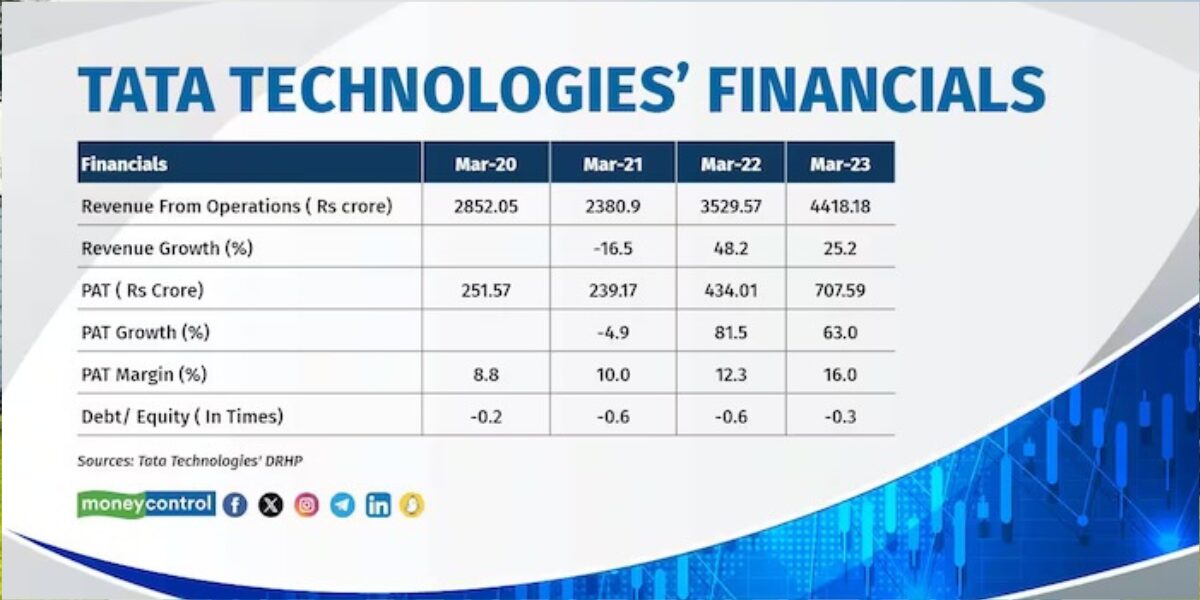

Examining Tata Tech’s financial statements offers valuable insights into its stock performance:

- Revenue and Profit Growth: Increasing revenue and profitability signal strong financial health.

- Operating Margins: Effective cost management and operational efficiency lead to improved profit margins.

- Return on Equity (ROE): ROE evaluates how well the company generates profits from its shareholders’ equity, reflecting overall financial strength.

Expert Opinions on Tata Tech Share Price

Financial analysts provide forecasts and recommendations through detailed analysis. Their insights into Tata Tech’s future performance and market trends can guide investors in making informed, strategic decisions.

Investment Tips for Tata Tech Shares

When investing in Tata Tech shares, consider the following tips:

- Long-Term Outlook: A long-term investment approach can capitalize on Tata Tech’s growth potential.

- Diversification: Diversifying your portfolio across sectors helps reduce risk.

- Stay Updated: Continuously monitor financial reports and market trends to make informed decisions.

Comparative Analysis with Industry Peers

To assess Tata Tech’s market position, compare its share price trends with competitors like Infosys and Wipro. This analysis provides insights into its competitive advantage and potential for future growth.

ALSO READ> Best Platforms to Buy TikTok Likes and Attain Higher Fame

Future Outlook for Tata Tech

Tata Tech’s share price will be shaped by continued innovation, market expansion, and global economic trends. Analysts are optimistic about its future, bolstered by the company’s strategic initiatives and solid market standing.

As a reflection of its financial health and market position, Tata Tech’s share price responds to both internal performance and broader economic factors. Staying informed and strategic will help investors make decisions that align with their long-term financial objectives.